Calculate Land Transfer Stamp Duty

What is Land Transfer (Stamp) Duty in Victoria?

According the Victorian State Revenue Office, approximately 200,000 properties in Victoria are transferred each year, primarily through auctions and private sales. However, properties can also be obtained via gifts, or through a company or trust acquisition.

Regardless of the method of acquisition, land transfer duty (formerly known as stamp duty) must be paid on the transfer of land from one person to another. Essentialy, this is a tax on buying (or transfering) property. This duty amount varies based on the property’s value, its intended use, whether the buyer is a foreign purchaser, and any applicable exemptions or concessions.

💡Did you know – While we like to say “Stamp Duty” In Victoria, Land Transfer Duty is the more accurate term when talking about property transactions! Land Transfer Duty is the specific type of Stamp Duty, applied solely to the transfer of property ownership. It got carved out of the broader term, Stamp Duty, in the late ’90s! 🤯

☝️ Important – For this article, we will just use the words Stamp Duty to make it easier for everyone to read. You’re welcome.

How is Stamp duty calculated?

Stamp Duty is calculated on the dutiable value of your property. This is the price you paid for the property or its market value, whichever is greater. Duty is calculated on a sliding scale, starting at 1.4% for properties valued at $25,000, and rising to 6.5% depending on the value of your property and when the agreement or arrangement for the transfer was entered into.

According the Victorian State Revenue Office, the dutiable value of a property is defined as “the price you paid for the property or its market value, whichever is greater, and includes any GST payable. The dutiable value also includes late settlement interest resulting from a late settlement, or from a a settlement failing and being rescheduled.”

source: Victorian SRO – Dutiable Value of a property defined

What are the Stamp Duty rates in Victoria?

Stamp Duty Rates For Buying A Principal Place Of Residence

These rates apply when you’re buying a home, often referred to as your principal place of residence.

| Dutiable Value Range | Rate |

| $0-$25,000 | 1.4% of the dutiable value of the property |

| $25,000-$130,000 | $350 plus 2.4% of the dutiable value in excess of $25,000 |

| > $130,000 – $440,000 | $2870 plus 5% of the dutiable value in excess of $130,000 |

| > $440,000 – $550,000 | $18,370 plus 6% of the dutiable value in excess of $440,000 |

| More than $550,000 | The principal place of residence concessional rate does not apply. Please refer to the general land transfer duty rates |

Source: Victorian State Revenue Office – Principal Place of residence duty rates

Stamp Duty Rates For Buying A Non-Principal Place Of Residence

These rates apply when you’re buying another property other than your home. It could be a holiday home or an investment property, but it’s not your principal place of residence.

| Dutiable Value Range | Rate |

| $0-$25,000 | 1.4% of the dutiable value of the property |

| $25,000-$130,000 | $350 plus 2.4% of the dutiable value in excess of $25,000 |

| > $130,000 – $960,000 | $2870 plus 5% of the dutiable value in excess of $130,000 |

| > $960,000 – $2,000,000 | 5.5% of the dutiable value |

| More than $2,000,000 | $110,000 plus 6.5% of the dutiable value in excess of $2,000,000 |

Source: Victorian State Revenue Office – Non-Principal Place of residence duty rates

☝️ Hot Tip – Use a Stamp Duty Calculator to help work out how much it will cost you in Victoria.

Can Stamp Duty be part of my deposit in Victoria?

The short answer is no. Stamp Duty is paid by the purchaser when you are buying a property. It is paid on top of any deposit that you have agreed to as part of the contract of sale. Stamp Duty is always a seperate cost that is on top of what you agree to pay for a property.

If you have been lucky enough to save up and have a 10% deposit, the amount of Stamp Duty that you will then need to pay is a seperate cost.

Let’s take a look at an example of a first home buyer, purchasing a home in Victoria

Purchase Price: $650,000 with a 10% deposit

Deposit on purchase = $65,000

Money lent to you via a home loan = $585,000

Costs and fees = $15,112.17

Costs made up of:

- Stamp Duty on purchase: $11,356.67

- Transfer fees: $1,627

- Registration fees: $128.50

- Solicitor/Conveyancer (estimate): $1,500

- Building and pest inspections (estimate): $500

In the above example, we might be borrowing on a 90% loan (LVR) using a deposit of 10% which means a home loan of $585,000, but the total that you need to contribute to getting your home is very different.

The total of money that needs to come from you is actually the 10% deposit of $65,000 + costs and fees of $15,112.17 = Total deposit required of $80,112.17

So in the above example, you’re actually needing a deposit closer to 12.5% of the purchase price once you factor in costs!

Who needs to pay Stamp Duty?

Many buyers and investors often ask this question and it’s a very important one to make sure you understand.

The party who purchases the property is responsible for paying Stamp Duty in Victoria. If you’ve bought a property in Victoria, you will pay stamp duty once the sale or transfer is complete.

An exemption may apply for different circumstances which can reduce the amount of Stamp Duty payable. If you’re a first home buyer in Victoria, then exemptions may apply to you.

Your conveyancer or solicitor will lodge an application on your behalf and we don’t usually recommend the DIY approach when purchasing.

💡 Read more: – DIY conveyancing: is it a good idea to do your own?

To summarise, who needs to pay stamp duty?

- ✅ Those who have already purchased their first property (buying their second or third property).

- ✅ The buyer pays it – not the seller.

- ✅ It needs to be paid within 30 of settlement of the transaction (though each state has different rules), but in most cases is paid on the day of settlement.

- ✅ If you are a first home buyer but your property value is over certain value thresholds you will be required to pay stamp duty.

What is the Stamp Duty for Foreign Buyers In Victoria?

In addition to stamp duty, a foreign buyer must also pay an additional duty rate of 8%.

Therefore, if a foreigner is buying a property in Victoria valued at $960,001 then the total duty paid would be 13.5% of the property value (5.5% stamp duty + 8% additional duty).

The Victorian State Revenue Office defines a Foreign Puchaser as a foreign natural person, a foreign corporation or a trustee of a foreign trust.

Foreign natural persons

You are a foreign purchaser if you:

- are not an Australia citizen

- are not a New Zealand citizen with a Special Category Visa (Subclass 444). To hold this visa, the New Zealand citizen must be physically present in Australia, or

- do not hold an Australian permanent residence visa.

Foreign corporations

A foreign corporation includes corporations incorporated:

- outside Australia.

- in Australia if a foreign natural person, another foreign corporation, or a trustee of a foreign trust has a controlling interest in those corporations.

Foreign trusts

A foreign trust is a trust where a foreign natural person, foreign corporation or trustee of another foreign trust, has a substantial interest in the trust estate of that trust.

There are stamp-duty exemptions for foreign buyers under the following conditions:

- You are a New Zealand citizen with a special category visa (Subclass 444).

- You are a citizen or permanent resident of Australia.

- You are buying a home with a spouse/partner who is an Australian citizen, permanent resident or New Zealand citizen with a special category visa.

- Must live in the property as the principal place of residence continuously for 12 months after becoming entitled to the property.

- A foreigner acquires the property under a will.

- The property acquisition qualifies for the First Home Owners Grant.

- The property is transferred between partners (including if the property is transferred after a relationship breakdown).

When does Stamp Duty need to be paid?

Stamp Duty in Victoria needs to be paid within 30 days of settlement of the property transaction. If you are settling electronically, it might have to be paid on the day of settlement. Regardless of the method it is usually paid at settlement of the purchase in most instances.

⚠️ Note about Titles – The property title won’t be transferred to the buyer’s name until stamp duty is paid. Always check with your legal representative about title issues.

It’s pretty important to be aware of the timing of your required payment of stamp duty in Victoria so that you can avoid any potential problems that might arise and spoil the big day of settlement! Here’s how the process works.

Stamp Duty process

- The amount of Stamp Duty payable in Victoria will be worked out by your solictor or coveyancer prior to settlement.

- Stamp Duty rebates will be calculated prior to settlement by your conveyancer or solicitor and they will apply those rebates to the amount payable.

- Your solictor or conveyancer will notify you of the total amount of Stamp Duty that is payable on your property transaction in Victoria. This will be the total amount that you will need to pay.

☝️ Important – We recommend to always use a conveyancer or solicitor when purchasing property. They will also know if you’re eligible for any exemptions too; could save you money doing it right.

Are there any exemptions from Stamp Duty in Victoria?

There are! The great news for first home buyers looking to purchase their home in Victoria, is that there’s an exemption from paying stamp duty if the value of the property is $600,000 or less. So, in these situations, stamp duty = $0.

Are there any concessions to reduce Stamp Duty in Victoria?

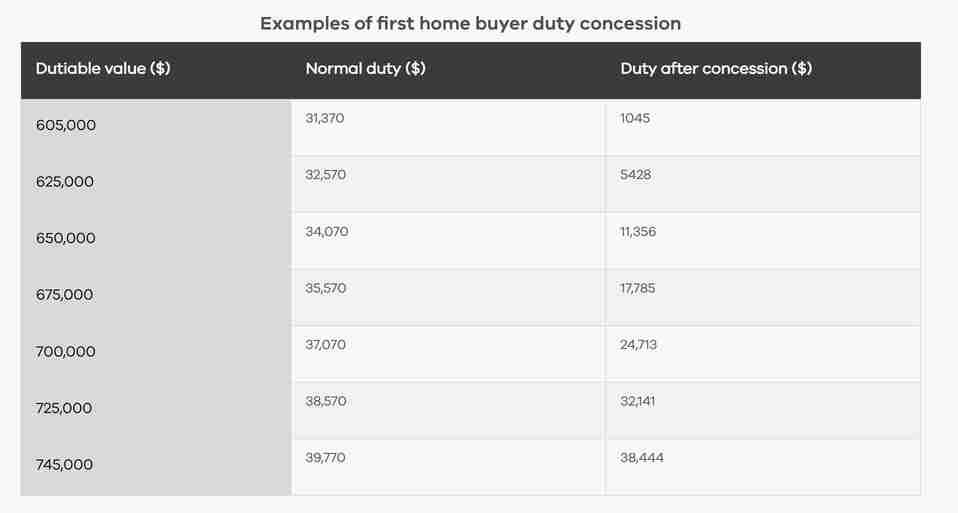

What about if the property is over $600,000? There are still first home buyer concessions that are available on a sliding slace to help reduce the amount of stamp duty payable. The stamp duty concessions apply for first home buyers purchasing a property that has a value between over $600,000 and up to $750,000.

In order to claim the first home buyer duty exemption or concession, the buyer still needs to satisfy all the requirements of the First Home Owner Grant eligiblity criteria and at least one purchaser needs to satisfy the residency requirements.

Example concession savings:

Other exemptions and concessions available in Victoria

A number of exemptions and concessions for land transfer duty are available. Many of these are aimed at homebuyers, but others include:

- Deceased estates – an exemption on a transfer of land by the executor of a deceased person to a beneficiary.

- Transfer between spouse or partner – an exemption for transfers between partners and spouses, including transfers arising out of a breakdown of a relationship.

- Regional commercial, industrial and extractive industries properties – a concession if you buy property in regional Victoria for commercial, industrial or extractive industry use under a contract entered into on or after 1 July 2019.

- Family farms – an exemption for the transfer of the family farm, depending on the class of the land, the nature of the transfer, and the status of the parties involved in the transfer.

- Young farmers – a one-off duty exemption/concession for young farmers buying their first farmland property.

- Special disability trusts or transfer to someone with a disability – exemptions are available in certain circumstances, where a home is provided for a person with a disability.

- Corporate consolidation – a concession where corporate groups form a single entity for tax purposes by interposing a company between the existing head trust or company and its unitholders or shareholders and all its subsidiary entities.

- Corporate reconstruction – a concession where a corporate group reorganises its business structure (e.g. transferring assets between corporations that are members of the corporate group).

- Charities and friendly societies – certain exemptions from land transfer duty may be available.

More exemptions and concessions are available, especially for first-home owners and pensioners, and you may be eligible for more than one.

⚠️ IMPORTANT – Always discuss these options with your conveyancer and/or representative before settlement.

Why does the Victorian Government charge Stamp Duty?

Okay, imagine you’re at a music festival. Tickets aren’t free, right? Someone gotta pay for the bands, security, porta-potties (hopefully clean ones!), and all the other stuff that makes it happen. It’s kinda like that with owning a house in Victoria: there’s gotta be money to keep things running.

Here’s the deal with stamp duty:

- Think of it as a “welcome tax.” When you buy something valuable, like a house, the government charges you a bit extra to say “hey, welcome to the property club!” This extra cash helps them fund things like schools, hospitals, roads, and all the other goodies that make living in Vic so awesome.

- It’s a big chunk of change. We’re talking thousands, sometimes even tens of thousands of dollars, depending on how swanky your new digs are. But hey, remember that music festival? All those things don’t come free!

- Not everyone pays the full whack. First-time homebuyers get a sweet discount, and there are other exemptions for things like inheriting a property or buying off-the-plan. Plus, some states are trying out new taxes that aim to be fairer, like the proposed Commercial and Industrial Property Transfer Duty in Vic.

- Love it or hate it, it’s a major player. Stamp duty brings in a LOT of money for the government, about $8.5 billion in Vic alone! That’s like paying for every single person in the state to go to that music festival twice.

Now, the downsides:

- It can be a major hurdle for first-time buyers. Saving up for a house is hard enough, and a big stamp duty bill can feel like a slap in the face. It can also push prices up, making housing even less affordable.

- It’s not the most efficient tax. It’s a one-time hit, so it doesn’t capture people who own multiple properties or who get richer over time. Plus, it can discourage people from moving, which isn’t great for the economy.

So, is it good or bad? That’s a tough one. It’s true that stamp duty raises a lot of money for important things, but it can also make it harder for young people to get on the property ladder. Ultimately, it’s a complex issue with pros and cons.

How much will Stamp Duty cost me in Victoria?

It varies from one state to another. Territory and state governments determine the amount required to be paid. It isn’t always easy to calculate the amount you owe in stamp duty, because every state charges a different rate. So always be sure that you’re looking up your state specifically, so for the sake of this article, we’ve focused on Victoria.

This can be quite confusing for first time home buyers. But the good news is, you can calculate the amount using an online calculator. A great start is at the top of the page with our Stamp Duty Calculator for Victoria!

Key points to know:

- Each state and territory will have their own calculators online and you can check the equivalent State Revenue Office for where you’re looking to buy.

- Chat to the Well Money team to check for more information about Stamp Duty in Victoria and to see what we can do to help.

- $52,436. The average stamp duty amount for the average purchase property price in Victoria!

NOTE: The above amount of stamp duty is calculated in January 2024 and the property price is from the ABS stats released in 2022 for the average purchase price being $956,100.

💡 Read more: – Hidden home loan fees (and how to avoid them)

I’m not quite sure what applies to me. Can you help?

If you are looking to purchase a home or investment property in Victoria, our team at Well Money can help.

What we do is make it simple to get through the home loan process, and with our team of experts, we will help walk you through the process to complete your first home buyers grant.

To chat about your deposit, lending and first home ownership options book in a time to sit down with us, or feel free to call on 1300 899 724.