The COVID-19 pandemic has caused economies across the world to come to a standstill. Social distancing restrictions have led many people to stay at home and non-essential businesses to close.

In times of heightened uncertainty like these, it is natural to worry about the impact on our economy. But before the pandemic, the Australian economy was considered one of the world’s strongest. We had enjoyed an uninterrupted 28 years of annual growth – a record unmatched by any other advanced economy.

This record was no fluke, but the result of good fundamentals. These fundamentals have not changed. And history shows us that no matter what internal and external shocks batter Australia, our economy always bounces back.

Our resilient economy

Over the years, Australia’s economy has shown remarkable resilience to negative events.

During the 20th century, there were two world wars, the Vietnam War, the Great Depression, regular recessions, two oil shocks and stagflation in the 1970s, the stock market crash of 1987 and the Asian Financial Crisis of 1997. This century, we’ve been hit by the 2008 Global Financial Crisis (GFC), the dotcom crash, the eurozone crisis, SARS, ebola, swine flu and, of course, COVID-19.

Despite all this, our economy has expanded by an average of 0.85% per quarter or 3.4% per year since 1959. We were one of only three major world economies to avoid a recession in the GFC.

While past performance is no guarantee of future performance, Australia is well placed to manage the economic fallout from COVID-19. We entered the crisis with a current account in surplus and a AAA credit rating with the three major rating agencies Moody’s, S&P and Fitch. As a result, the government has been able to support the economy with an unprecedented stimulus package.

Our resilient property market

As a homeowner or someone about to buy a new home, you might be worried about COVID-19’s impact on property prices. But time and again, the Australian property market has proved itself to be as resilient as our economy.

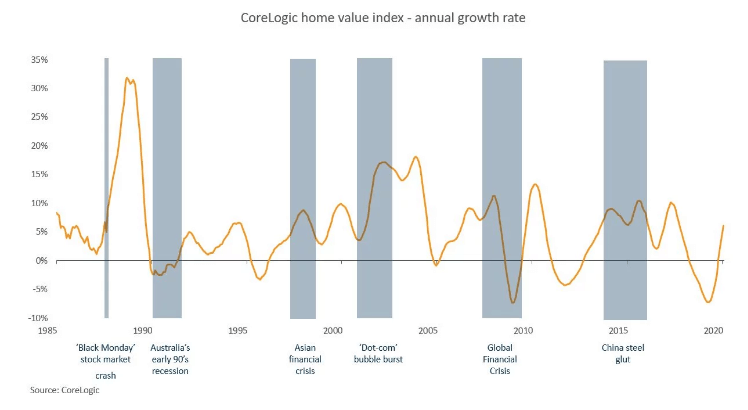

Over the past 33 years, there have been six major global events that have caused Australian property prices to fall. As the chart below shows, our property market has always bounced back after these shocks.

In fact, our property markets have recorded strong growth over the long-term as the table below shows.

| City | 1973 | 2020 | Growth | Average annual return |

| Sydney | $27,400 | $1,020,849 | 3,626% | 8.0% |

| Melbourne | $19,800 | $819,611 | 4,039% | 8.2% |

| Brisbane | $17,500 | $557,714 | 3,087% | 7.6% |

| Adelaide | $16,250 | $474,425 | 2,820% | 7.4% |

| Perth | $18,850 | $461,845 | 2,350% | 7.0% |

| Hobart | $15,200 | $513,325 | 3,277% | 7.8% |

| Canberra | $26,850 | $702,173 | 2,515% | 7.2% |

(Based on comparisons of 1973 median house prices in a Department of Parliamentary Services report with March 2020 median house prices from CoreLogic)

Well placed for future growth

Australia’s strong starting position entering this crisis is not the only advantage we have as we look to the future exiting it.

We have a stable political environment, we have strong democratic institutions and we’re one of the safest countries in the world. The country is blessed with plentiful natural resources, we are a major exporter of food and energy, and our population growth of 1.5% is above the global average of 1.05%. Literally millions of well-educated overseas residents are clamouring to move to Australia – and who can blame them?

So while the situation may be gloomy now, we will recover from it and are well placed for a brighter future.